MunicipalBonds.com provides information regarding the performance of muni bonds for the past week in comparison with Treasury yields and net fund flows, as well as the impact of monetary policies and relevant economic news.

- Treasury yields were all up big, while most municipal yields saw smaller gains this week.

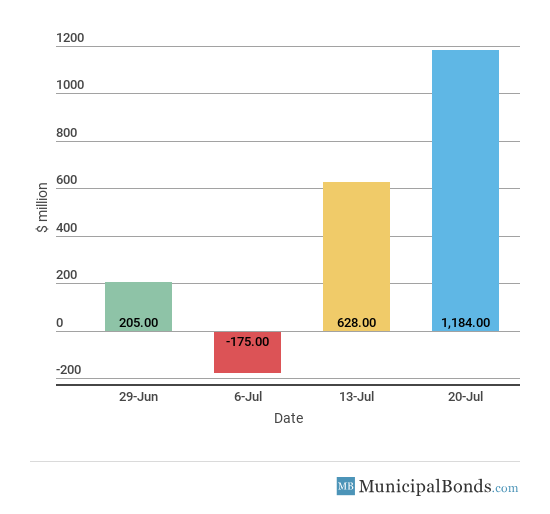

- Muni bond funds saw large inflows this week.

- Be sure to review our previous week’s report to track the changing market conditions.

Jobless Claims Hits Multi-decade Low

- Fed Chairman Jerome Powell gave the semi-annual monetary policy testimony before the House Financial Services Committee in Washington this week and he made no real commentary on his position on tariffs. He did speak on trade and how protectionism is bad for the economy.

- On Friday, President Trump tweeted that the Federal Reserve is undermining his efforts of improving the economy and that higher interest rates increase China’s competitive edge. This caused the U.S. Dollar to drop in value.

- Leading Indicators saw a month-over-month change of 0.5%, with the only weakness coming from building permits. This is a significant bump from the drop-off in June, suggesting the economy is gaining positive momentum.

- Jobless claims saw a drop of 8,000 this week to a total of 207,000, which was lower than the consensus amount and the lowest level since December 1969. The four-week average decreased this week, bringing the total to 220,500, which also remains around record-low levels.

- The Fed’s assets increased by $0.4 billion this week, bringing the total asset base to around $4.292 trillion.

- During the week, money supply (M2) decreased by $11.8 billion, a reversal of last week’s increasing trend.

Keep track of economic indicators that might impact the muni market.

Treasury Yields Jump, While Municipal Yields See Smaller Gains

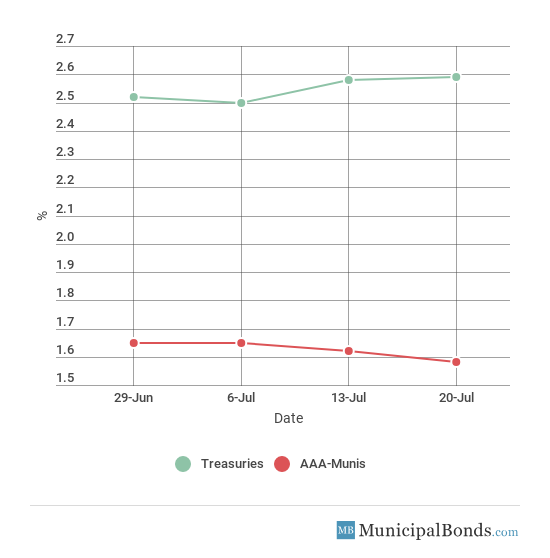

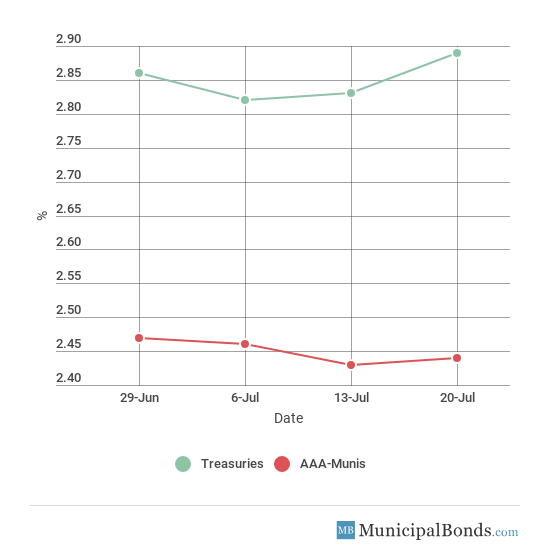

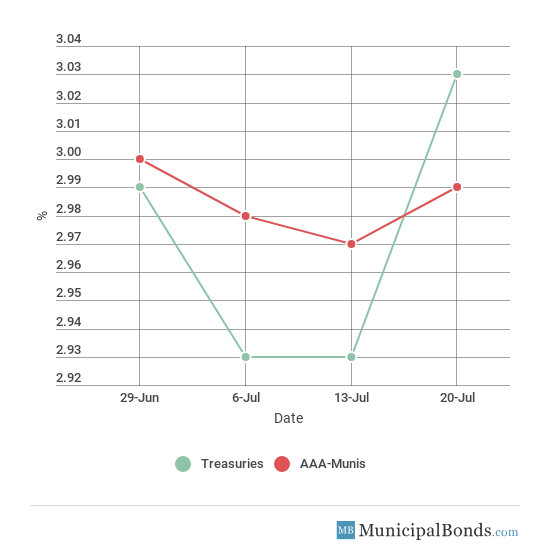

- Treasury yields saw big gains for the week, with the 2-year Treasury having an increase of 1 bps to yield 2.59%. The 10-year Treasury had an increase of 6 bps and now yields 2.89,%. The 30-year Treasury yield had an increase of 10 bps and now yields 3.03%. Municipal yields were mostly up this week with the exception of the 2-year AAA-rated bond that dropped 4 bps to yield 1.58%. The 10-year AAA-rated bond increased by 1 bps to yield 2.44%, while the 30-year AAA-rated bond increased 1 bps to yield 2.98%.

- Credit spreads increased this week, with the largest spread between the 2-year Treasury and the AAA-rated municipal bond widening up to 101 bps.

Be sure to check out our newly launched Municipal Bond Screener to explore muni bond CUSIPs across the U.S., based on custom parameters including the issuing state, insurance status and a range of different bond attributes such as maturity, coupon, price and yield.

2-Year Yield Movement

10-Year Yield Movement

30-Year Yield Movement

Credit Spread

| Maturity | Treasury Yield | Muni Yield | Spread (in BPS) |

|---|---|---|---|

| 2-year | 2.59% | 1.58% | 101 |

| 5-year | 2.76% | 1.93% | 83 |

| 10-year | 2.89% | 2.44% | 45 |

| 30-year | 3.03% | 2.99% | 4 |

Muni Bond Funds See Large Increase

- Municipal bond funds saw large inflows with an increase of $1.184 billion in assets under management this week.

Dormitory Authority of the State of New York Issues State Sales Tax Revenue Bonds (NY)

The largest issue of the week came from the Dormitory Authority of the State of New York, which issued over $1.78 billion in tax revenue bonds this week. The issuance consists of two series: the 2018C, which is issuing over $1.7 billion and is tax-exempt, and 2018D, which is issuing $73.9 million in federally taxable bonds. The Dormitory Authority provided financing in three areas in New York: public facilities, not-for-profit healthcare and independent higher education.

Rating Decision Updates on Muni Bonds

Upgrade

Moody’s upgrades Queens Ballpark Company LLC’s to Baa2 from Baa3; outlook stable: Moody’s upgraded the Queens Ballpark Company LLC’s outstanding bonds (GOULT) to Baa2 from Baa3 this week. The bonds were issued by the New York City Industrial Development Agency and affected $650 million of PILOT revenue, lease revenue and installment purchase bonds. The upgrade was warranted by the financial stability the ballpark has shown and is likely to continue in the future.

Downgrade

Moody’s downgrades Susquehanna University (PA) to A3; outlook stable: Moody’s has downgraded $55 million of outstanding rated debt of Susquehanna University (PA) to A3 from A2 this week. Although the school has had strong fiscal oversight, it has been dealing with a high tuition discount rate and constrained net tuition revenues. Thinning of operating performance along with growth in cash and investments has been lagging that of peers.

We provide this report on a weekly basis. To stay up to date with muni bond market events, return to our News page here.