MunicipalBonds.com provides information regarding the performance of muni bonds for the past week in comparison with Treasury yields and net fund flows, as well as the impact of monetary policies and relevant economic news.

- Treasury and municipal yields all dropped this week.

- Muni bond funds saw inflows for the fourth week in a row.

- Be sure to review our previous week’s report to track the changing market conditions.

Two Rate Hikes for 2018 In the Cards

- GDP data was released this week, as real GDP saw a quarter-over-quarter change of 2.0%, which was 0.2% lower than the consensus. The GDP price index saw a quarter-over-quarter change of 2.2%, higher than the expected 1.9%. The quarter saw its strength from business, as companies are getting a boost from the corporate tax cuts.

- With core personal consumption expenditure hitting the 2% mark in May, it seems that the Fed finally hit its target for the economy’s inflation goals. If inflation continues to stay stable, than the Fed could potentially implement two more rate hikes for 2018 and three in 2019.

- The Bloomberg Consumer Comfort Index saw another increase to 57.3, which is the best measure since April and shows that consumers are not too concerned with trade war or tariff issues.

- Jobless claims saw an increase of 9,000 this week to a total of 227,000, which was higher than the consensus amount of 220,000. The four-week average increased this week, bringing the total to 222,000, which is still hovering around record-low levels.

- The Fed’s assets decreased by $10.4 billion this week, bringing the total asset base to around $4.305 trillion.

- During the week, money supply (M2) increased by $19.8 billion, a continuation of last week’s $18.2 billion increase.

Keep track of economic indicators that might impact the muni market.

Treasuries and Municipal Yields Fall Again

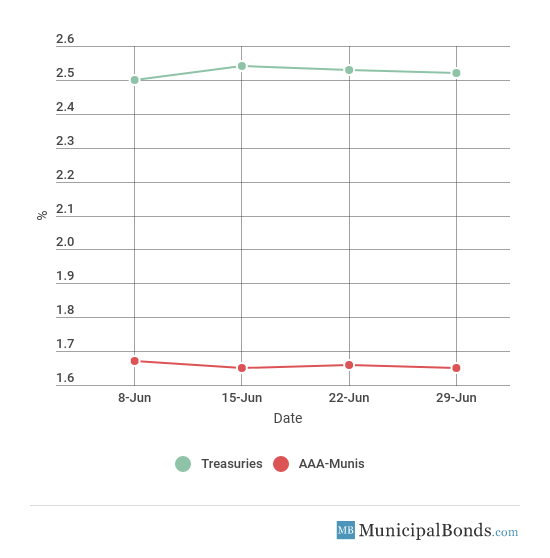

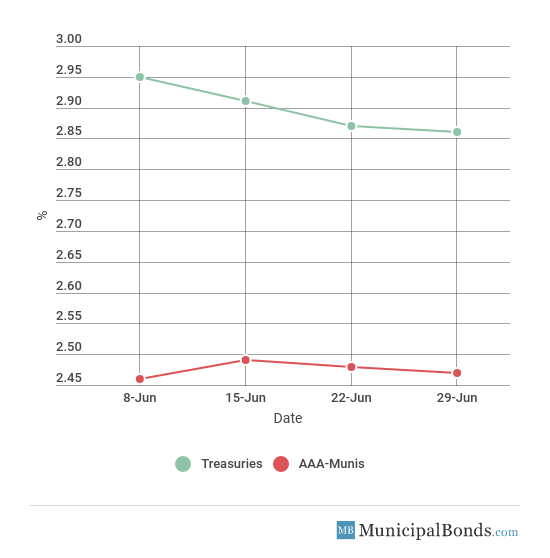

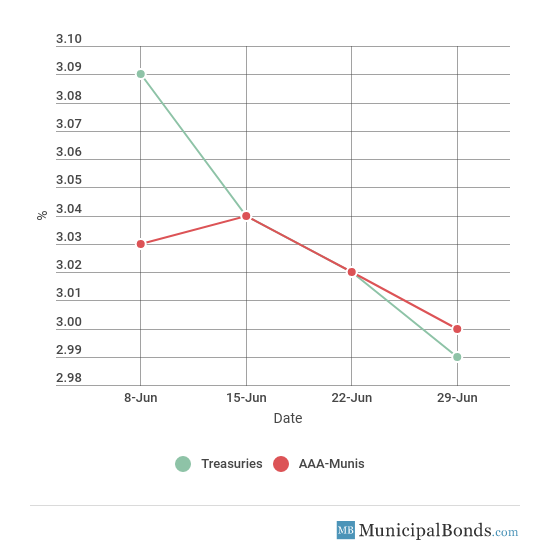

- Treasury yields mostly saw declines for the third week in a row, with the 2-year Treasury decreasing by 1 bps to yield 2.52%. The 10-year Treasury had a decrease of 1 bps and now yields 2.86%. The 30-year Treasury yield decreased by 3 bps and now yields 2.99%. Municipal yields were also down this week with the 2-year AAA-rated bond, which decreased 1 bps to yield 1.65%. The 10-year AAA-rated bond decreased by 1 bps to yield 2.47%, while the 30-year AAA-rated bond decreased 2 bps to yield 3.00%.

- Credit spreads remained unchanged this week, with the largest spread between the 2-year Treasury and the AAA-rated municipal bond still standing at 87 bps.

Be sure to check out our newly launched Municipal Bond Screener to explore muni bond CUSIPs across the U.S., based on custom parameters including the issuing state, insurance status and a range of different bond attributes such as maturity, coupon, price and yield.

2-Year Yield Movement

10-Year Yield Movement

30-Year Yield Movement

Credit Spread

| Maturity | Treasury Yield | Muni Yield | Spread (in BPS) |

|---|---|---|---|

| 2-year | 2.52% | 1.65% | 87 |

| 5-year | 2.74% | 2.00% | 74 |

| 10-year | 2.86% | 2.47% | 39 |

| 30-year | 2.99% | 3.00% | -1 |

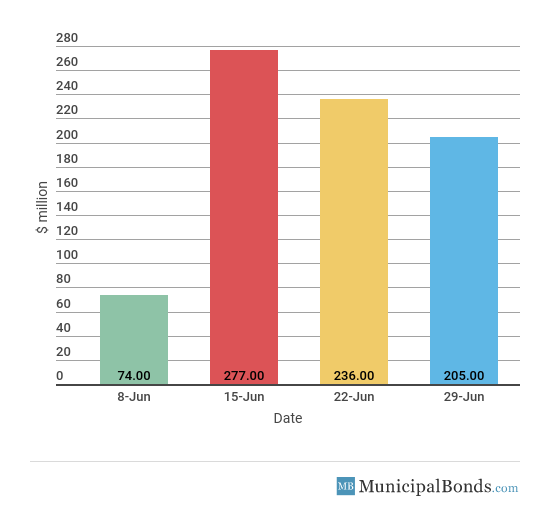

Muni Bond Funds See Inflows for Fourth Week

- For the fourth week in a row, muni bond funds saw positive inflows of $205 million this week.

Golden State Tobacco Securitization Corporation Issues Tobacco Settlement Asset-backed Bonds

The largest issue of the week comes from the Golden State Tobacco Securitization Corporation, which offered over $1.674 billion in Tobacco Settlement Asset-backed bonds. The proceeds are being used to refund the issuer’s Tobacco Settlement Asset-backed Series 2007 bonds.

Rating Decision Updates on Muni Bonds

Upgrade

Moody’s upgrades Woodburn Wastewater, OR’s sewer bonds to A1 and assigns Aa3 city issuer rating: The City of Woodburn, Oregon had its Wastewater Enterprise’s revenue and refunding bonds, Series 2011A and 2011B bonds upgraded to A1 from A2 this week. This affects $18.2 million of outstanding bonds. In conjunction, Moody’s issued the City of Woodburn an issuer rating of Aa3. The City has seen its debt and pension burdens fall thanks to responsible financial performance.

Downgrade

Moody’s downgrades Belle Vernon ASD, PA’s GO to Baa1; assigns stable outlook: The Belle Vernon Area School District of Pennsylvania had its general obligation debt downgraded to Baa1 from A3 this week. This affects over $26 million in outstanding debt due to an increasing debt burden, higher pension liabilities and narrowing reserves.

We provide this report on a weekly basis. To stay up to date with muni bond market events, return to our News page here.