MunicipalBonds.com provides information regarding the performance of muni bonds for the past week in comparison with Treasury yields and net fund flows, as well as the impact of monetary policies and relevant economic news.

- Treasury and municipal yields mostly dropped this week.

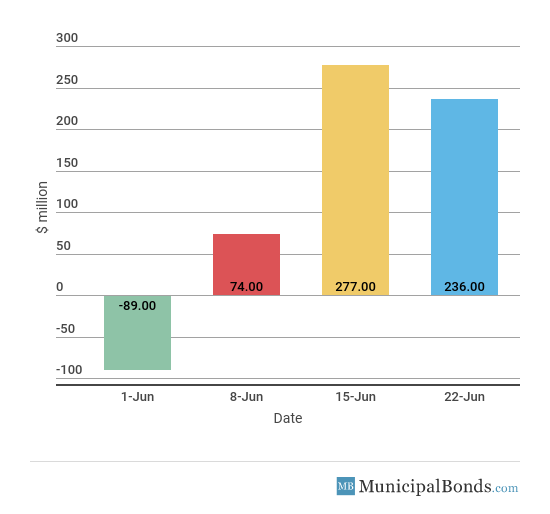

- Muni bond funds saw inflows for the third week in a row.

- Be sure to review our previous week’s report to track the changing market conditions.

Fed’s Powell Expects Rates to Keep Rising

- After raising rates last week, Fed Chair Jerome Powell spoke about how strong the economy is and that employment is “generationally” low. In the speech, he mentioned that inflation is close to the Fed’s target objective rate and that the Fed’s plan to continue to raise rates throughout the year is still strong.

- Leading indicators saw a month-over-month change of 0.2%, lower than the consensus of 0.3%. The ISM Manufacturing Index saw the largest increase in new orders and slowing comes from building permits.

- The Bloomberg Consumer Comfort Index saw another increase to 56.5, which is the best measure since May and just a few points below the 17-year high of 58.0 that was hit in April.

- Jobless claims saw a decrease of 3,000 this week to a total of 218,000, which was lower than the consensus amount of 220,000. The four-week average decreased this week, bringing the total to 221000, which is still hovering around record-low levels.

- The Fed’s assets decreased by $9.0 billion this week, bringing the total asset base to around $4.316 trillion.

- During the week, money supply (M2) increased by $20.0 billion, a continuation of last week’s $14.0 billion increase.

Keep track of economic indicators that might impact the muni market.

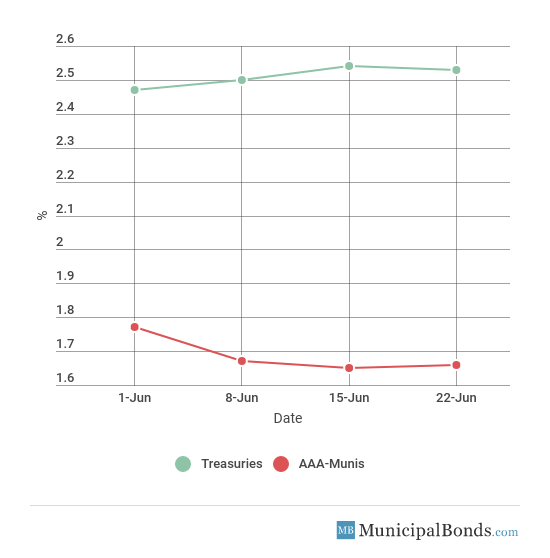

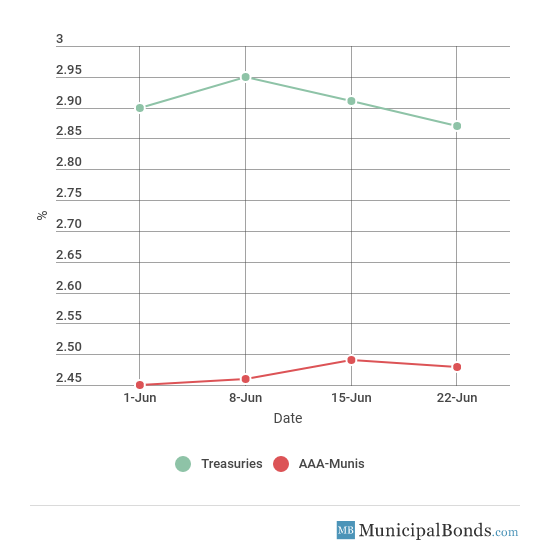

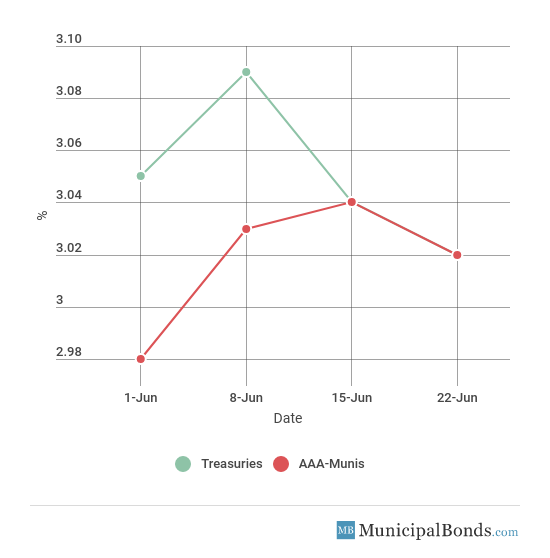

All Treasuries and Most Municipal Yields Fall

- Treasury yields mostly saw declines again this week, with the 2-year Treasury decreasing by 1 bps to yield 2.53%. The 10-year Treasury had a decrease of 4 bps and now yields 2.87%. The 30-year Treasury yield decreased by 2 bps and now yields 3.02%. Municipal yields were also mostly down this week with the exception of the 2-year AAA-rated bond, which increased 1 bps to yield 1.66%. The 10-year AAA-rated bond decreased by 1 bps to yield 2.48%, while the 30-year AAA-rated bond decreased 2 bps to yield 3.02%.

- Credit spreads increased this week, with the largest spread between the 2-year Treasury and the AAA-rated municipal bond now standing at 87 bps.

Be sure to check out our newly launched Municipal Bond Screener to explore muni bond CUSIPs across the U.S., based on custom parameters including the issuing state, insurance status and a range of different bond attributes such as maturity, coupon, price and yield.

2-Year Yield Movement

10-Year Yield Movement

30-Year Yield Movement

Credit Spread

| Maturity | Treasury Yield | Muni Yield | Spread (in BPS) |

|---|---|---|---|

| 2-year | 2.53% | 1.66% | 87 |

| 5-year | 2.75% | 2.01% | 74 |

| 10-year | 2.87% | 2.48% | 39 |

| 30-year | 3.02% | 3.02% | 0 |

Muni Bond Funds See Inflows for Third Week

- For the third week in a row, muni bond funds saw positive inflows of $236 million this week.

Metropolitan Transportation Authority New York Issues Transportation Revenue Bond Anticipation Notes

The largest issue of the week comes from the Metropolitan Transportation Authority of New York, which saw $1.6 billion in New York Transportation Revenue Bond Anticipation Notes come to market this week. The first subseries 2018 B-1 is made up of ten different subseries bonds, equalling to $800 million. The second subseries 2018 B-2 is made up five different subseries bonds, equalling to $800 million. The proceeds are being used to finance existing approved transit and commuter projects around New York State. The bonds are not rated.

Rating Decision Updates on Muni Bonds

Upgrade

Moody’s upgrades River Place M.U.D., TX GOULT to Aaa from A1 after assumed by City of Austin, TX; outlook stable: The River Place Municipal Utility District of Texas had its bonds upgraded to Aaa from A1, which affected $860,000 of outstanding General Obligation Unlimited Tax Refunding Bonds, Series 2009. The CIty of Austin assumed the district’s payment, which directly benefits from its proximity to the University of Texas and acting as the state’s capital.

Downgrade

Moody’s downgrades Demorest, GA W&S to Baa3; outlook stable: The city of Demorest, Georgia, saw its water and sewer bond downgraded to Baa3 from A3 this week. This downgrade was due to the city’s narrowing reserves and smaller service area.

We provide this report on a weekly basis. To stay up to date with muni bond market events, return to our News page here.