MunicipalBonds.com provides information regarding the performance of muni bonds for the past week in comparison with Treasury yields and net fund flows, as well as the impact of monetary policies and relevant economic news.

- Treasury yields mostly drop while municipal yields mostly see increases this week.

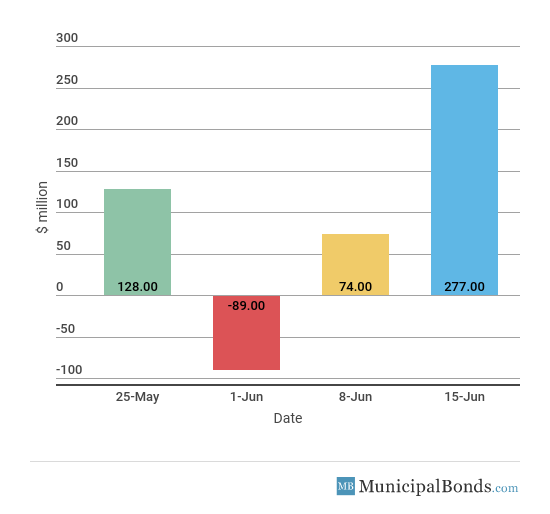

- Muni bond funds see inflows for second week in a row.

- Be sure to review our previous week’s report to track the changing market conditions.

Fed Raised Rates by 0.25%

- As expected, the Federal Open Market Committee met this week and raised the federal funds rate by 0.25% to the range of 1.75% to 2.00%. This marks the second rate hike for 2018 and consensus expects there to be at least one, if not two, more rate hikes before the year is over.

- The Consumer Price Index saw a month-over-month change of 0.2% and a year-over-year change of 2.8%, both matching consensus. Gasoline saw the largest increase of 1.7% while airfares saw the largest decrease of 1.9%.

- The Bloomberg Consumer Comfort Index saw an increase to 55.8, which suggests that consumers are feeling very confident in the strength of the economy.

- Jobless claims saw a decrease of 4,000 this week to a total of 218,000, which was lower than the consensus amount of 225,000. The four-week average decreased this week, bringing the total to 224,250, but it is still hovering around record-low levels.

- The Fed’s assets increased by $5.7 billion this week, bringing the total asset base to around $4.325 trillion.

- During the week, money supply (M2) increased by $13.8 billion, a continuation of last week’s $33.0 billion increase.

Keep track of economic indicators that might impact the muni market.

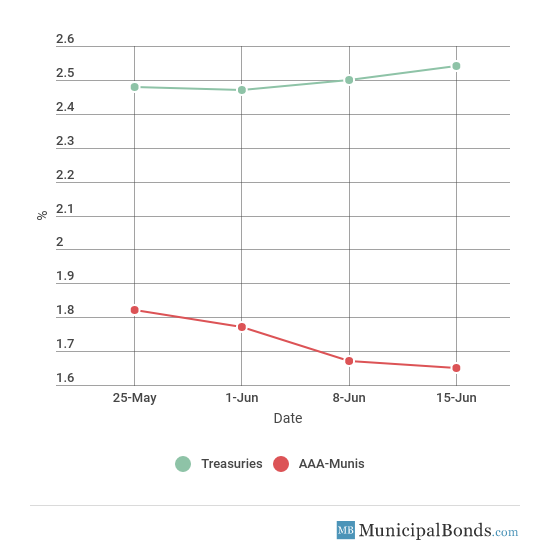

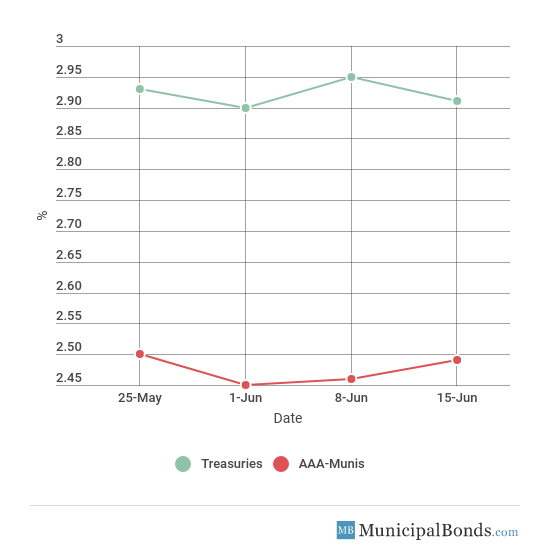

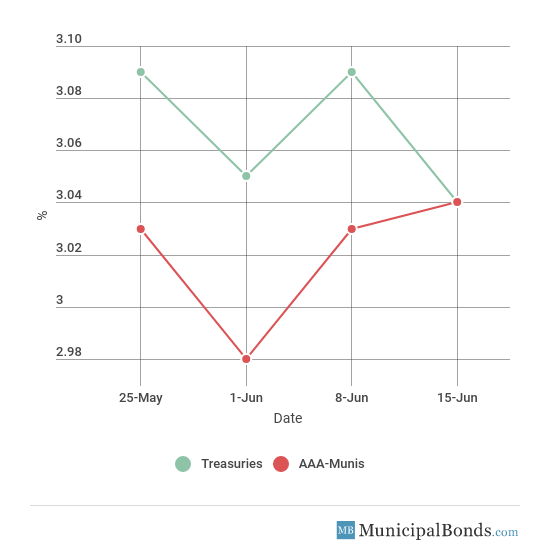

Longer-Term Treasuries Drop While Municipal Yields Gain

- Treasury yields mostly saw declines this week, with the exception of the 2-year Treasury that increased 4 bps to yield 2.54%. The 10-year Treasury had a decrease of 4 bps and now yields 2.91%. The 30-year Treasury yield decreased by 5 bps and now yields 3.04%. Municipal yields were mostly up this week with the exception of the 2-year AAA-rated bond, which fell 2 bps to yield 1.65%. The 10-year AAA-rated bond increased by 3 bps to yield 2.49%, while the 30-year AAA-rated bond also increased 1 bps to yield 3.04%.

- Credit spreads increased this week, with the largest spread between the 5-year Treasury and the AAA-rated municipal bond now standing at 79 bps. Meanwhile, the spread between the 30-year securities declined to 6 bps.

Be sure to check out our newly launched Municipal Bond Screener to explore muni bond CUSIPs across the U.S., based on custom parameters including the issuing state, insurance status and a range of different bond attributes such as maturity, coupon, price and yield.

2-Year Yield Movement

10-Year Yield Movement

30-Year Yield Movement

Credit Spread

| Maturity | Treasury Yield | Muni Yield | Spread (in BPS) |

|---|---|---|---|

| 2-year | 2.50% | 1.67% | 83 |

| 5-year | 2.79% | 2.00% | 79 |

| 10-year | 2.95% | 2.46% | 49 |

| 30-year | 3.09% | 3.03% | 6 |

Muni Bond Funds See Inflows Again

- After seeing $74 million of inflows last week, muni bond funds saw another increase of assets under management of $277 million this week.

Massachusetts Educational Financing Authority Issues Education Loan Revenue Bonds

The largest issue of the week comes from the Massachusetts Educational Financing Authority, which issued over $306 million in Education Loan Revenue Bonds. There are three different issues: the Senior Series 2018A, which consists of $158 million in bonds that are federally taxable, Senior Series 2018B, which consists of $113 million that are subject to AMT, and Subordinate Series 2018C, which consists of $33 million that are also subject to AMT. The Series 2018A and 2018B bonds are rated AA by S&P Global Ratings and the Series 2018C are rated BBB by S&P.

Rating Decision Updates on Muni Bonds

Upgrade

Moody’s upgrades Burr Ridge Park District, IL to Aa1: The Burr Ridge Park District, Illinois had $3.4 million of its general obligation limited tax (GOLT) bonds upgraded to Aa1 from Aa2. The Chicago-based area has seen its wealth levels increase, thanks to a growing tax base and an increase in reserves.

Downgrade

Moody’s downgrades Brookfield, WI to Aa1; outlook stable: Moody’s downgraded the City of Brookfield, Wisconsin’s general obligation (GO) debt to Aa1 from Aaa this week. This downgrade has affected $76.5 million of total debt and, at the same time, Moody’s also assigned an Aa1 rating to the City’s $3 million Taxable Bond Anticipation Notes. The City has seen increasing risks in the financing of land that will be used for a new city-owned convention center.

We provide this report on a weekly basis. To stay up to date with muni bond market events, return to our News page here.